It comes as no surprise, with financial challenges impacting everyone’s pockets, that parents are prioritising worries regarding their children’s finances above their own, a trend highlighted in a recent survey of advisers*.

According to the survey, 55% of respondents specified that amid cost-of-living challenges adult children were being prioritised in clients’ wealth planning, with many stepping in to help with their offspring’s financial struggles.

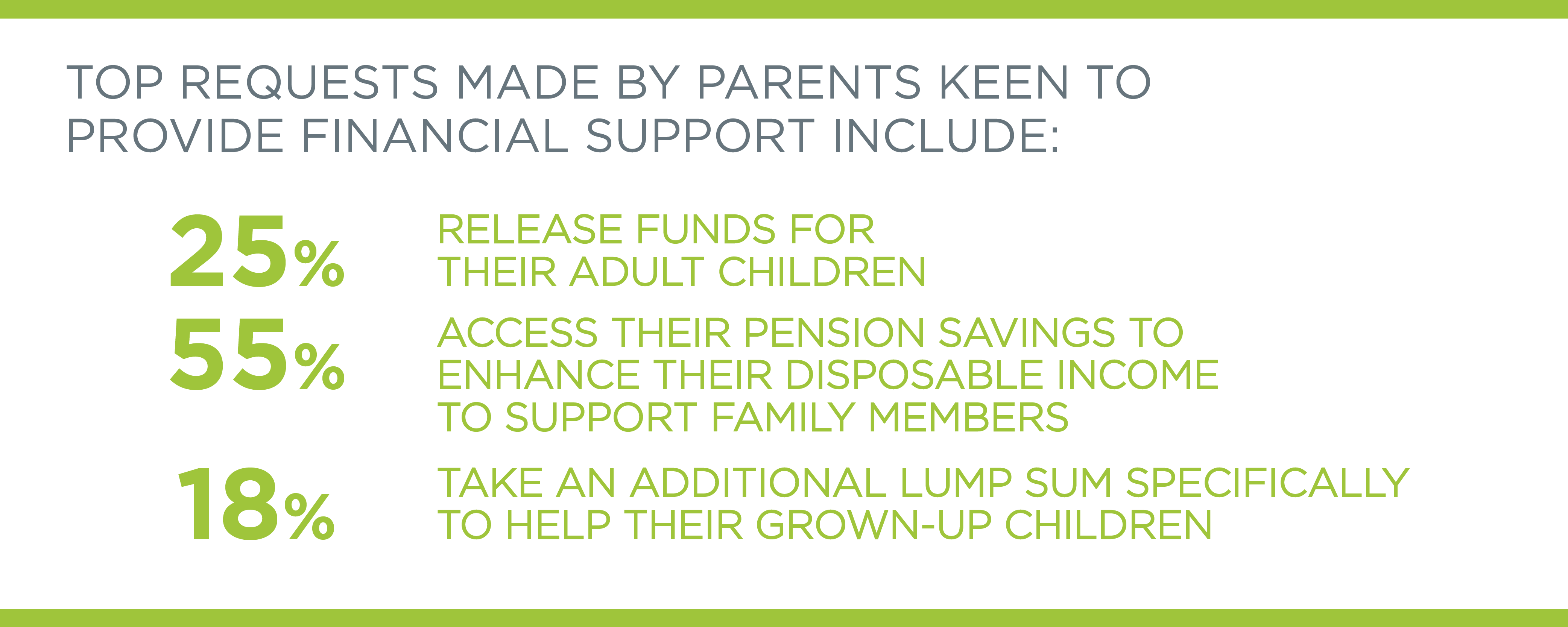

Top requests made by parents keen to provide financial support include releasing funds (25%) for their adult children. While 55% of the surveyed advisers have clients choosing to access their pension savings to enhance their disposable income to support family members, with 18% of those clients taking an additional lump sum specifically to help their grown-up children. Over half of advisers have clients keen to adjust their finances, with 40% reportedly requesting advice on ensuring investments stay ahead of inflation.

Although people are understandably concerned about their children’s financial circumstances, it’s important to be mindful about striking the right balance and not to lose focus on your own financial objectives.

*Royal London, 2023

The value of the investment and the income they produce can go down as well as up and you may not get back as much as you put in.

You can find interesting and up-to-date financial news on the Quilter website.

Approver Quilter Financial Services Limited & Quilter Mortgage Planning Limited. 27.09.2023